Simplifying Homeownership

See EXACTLY How Much Home You Qualify For Today!

Simplifying Homeownership

See EXACTLY How Much Home You Qualify For Today!

Learning Center

FHA Loan Changes: Non-Permanent Residents No Longer Eligible—What Seattle Homeowners Must Know

New FHA loan policy changes now exclude non-permanent residents from eligibility—impacting many Seattle homebuyers, especially those on work visas. Learn how this affects you, what alternative loan op... ...more

Products ,Market

March 26, 2025•2 min read

Navigating the Economic Shifts: What Powell's Speech Means for Seattle Homebuyers and Mortgage Brokers

Explore how Federal Reserve Chair Jerome Powell's latest speech impacts Seattle homebuyers and mortgage brokers. Understand what potential rate cuts mean for your mortgage and housing decisions in 202... ...more

Market

August 23, 2024•3 min read

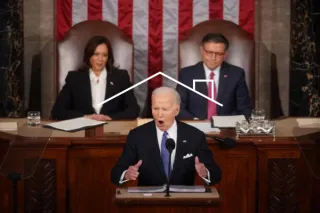

Breaking Down President Biden's Bold Plan to Tackle America's Housing Crisis

Dive into President Biden's comprehensive strategy to address the housing affordability crisis in America. From tax credits for homebuyers to innovative initiatives for renters, discover how this plan... ...more

Market

March 14, 2024•2 min read

Navigating 2024: A Positive Outlook for the Economy

Dive into the economic landscape of 2024 with insights from Loan Officer Said Hamood. Explore the Federal Reserve's strategies, rate cuts, and their impact on the housing market in Seattle. Discover k... ...more

Market

January 02, 2024•3 min read

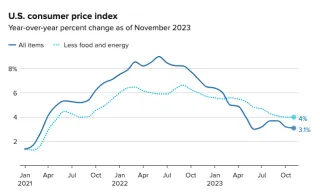

Decoding the Latest Inflation Data: What It Means for Loans and Rates

Delve into the latest economic insights with our comprehensive blog post, crafted by Said Hamood, a seasoned loan officer in Washington State. Explore the implications of the recent Consumer Price Ind... ...more

Market

December 12, 2023•2 min read

Unlock Your Dream Home: Exclusive 1% Lower Rate & $600 Credit in Marysville! 🏡✨ | WA First-Time Homebuyer Special

"Step into the serenity of Marysville, WA, where this charming home awaits! 🏡✨ Nestled in a vibrant neighborhood, this property boasts a welcoming front entrance and lush green landscaping, creating ... ...more

Market

December 12, 2023•2 min read

What is the first step in buying a home?

The first step is understanding your budget and getting pre-approved for a mortgage. This helps you know what you can afford and shows sellers that you're a serious buyer. I can guide you through this process to make sure you're prepared and confident.

How much money do I need for a down payment?

Down payments typically range from 3% to 20% of the home’s purchase price, depending on the type of loan you qualify for. There are also programs for first-time homebuyers that may offer down payment assistance. I can help you explore your options.

What does pre-approval mean, and why is it important?

Pre-approval means a lender has evaluated your financial information and determined the loan amount you're eligible for. It’s crucial because it gives you a clear idea of your budget, helps you compete with other buyers, and speeds up the closing process once you find a home.

What types of loans are available for first-time homebuyers?

There are several loan options, including FHA loans, USDA loans, and conventional loans. The best option for you depends on factors like your credit score, income, and the location of the home. I can help you compare the options and choose the best one for your situation.

How do I know if I qualify for a mortgage?

Lenders look at factors like your credit score, income, debt-to-income ratio, and the amount of money you have for a down payment. The good news is that I work with a range of clients, from those with perfect credit to first-time buyers, to help you find the right path to homeownership.

What are closing costs, and how much should I expect to pay?

Closing costs usually range from 2% to 5% of the home's purchase price and cover fees like appraisals, inspections, and lender charges. I’ll help you understand all the costs involved so there are no surprises at the end of the process.

Can I get a mortgage if I have student loans or other debt?

Yes! Many buyers with student loans or other forms of debt still qualify for a mortgage. Lenders look at your overall financial picture, including your income and debt-to-income ratio. Let’s talk through your situation, and I’ll help you find the best solution.

How long does the home buying process take?

The process typically takes about 21 to 45 days from the time you make an offer to closing. However, this can vary depending on factors like inspections, appraisals, and the lender's processing time. I’ll keep you updated every step of the way so you know what to expect.

What happens if my offer on a home is accepted?

Once your offer is accepted, the next steps include signing a purchase agreement, scheduling inspections, and finalizing your mortgage application. From there, the lender will process your loan, and we'll work together to ensure everything is in place for a smooth closing.

How do I know if I’m ready to buy a home?

If you’re financially stable, have a reliable income, and can afford a down payment and monthly mortgage payments, you might be ready. I’ll help you assess your financial readiness and guide you through the process to ensure you’re making the best decision for your future.

What is an FHA loan?

An FHA loan is a government-backed mortgage designed to help first-time homebuyers and those with less-than-perfect credit. It typically requires a lower down payment (as low as 3.5%) and has more flexible credit requirements, making it an excellent option for those who might not qualify for conventional loans.

What is a VA loan, and who qualifies?

A VA loan is a mortgage loan backed by the U.S. Department of Veterans Affairs, designed for military service members, veterans, and certain members of the National Guard and Reserves. It typically requires no down payment or private mortgage insurance (PMI), making it a great option for those who qualify.

What is a USDA loan?

A USDA loan is a government-backed mortgage offered to homebuyers in rural and suburban areas. It requires no down payment and offers competitive interest rates. To qualify, buyers need to meet income and property location requirements, making it a great option for those looking to buy in rural areas.

What is a conventional loan?

A conventional loan is a mortgage that is not insured or backed by the federal government. These loans usually require a higher credit score and a larger down payment than FHA loans, but they come with more flexible terms and potentially lower mortgage insurance costs if you put down at least 20%.

What is a jumbo loan?

A jumbo loan is a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are typically used for luxury or high-value homes and require stricter credit and income qualifications. They also tend to have higher interest rates due to the larger loan amounts.

What is a fixed-rate mortgage?

A fixed-rate mortgage is a loan with an interest rate that stays the same throughout the life of the loan, typically 15, 20, or 30 years. This provides stability and predictable monthly payments, making it a popular choice for many homebuyers.

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage (ARM) is a type of loan where the interest rate can change periodically based on market conditions. ARMs typically start with lower rates for the first few years and then adjust. While this can offer lower initial payments, it comes with more risk as rates can increase over time.

What is a renovation loan?

A renovation loan, like the FHA 203(k) loan, allows you to finance both the purchase of a home and the cost of repairs or renovations in one loan. This can be a great option if you want to buy a fixer-upper and make improvements to it, as it allows you to finance the project upfront.

"I educate first-time homebuyers so they can make informed decisions"

Said Hamood - Seattle Mortgage Broker - NMLS#1827048

Said Hamood | NMLS #1827048 | Barrett Financial Group, L.L.C. | NMLS #181106 | 275 E Rivulon Blvd, Suite 200, Gilbert, AZ 85297 | TX view complaint policy at www.barrettfinancial.com/texas-complaint | WA MB-181106 | Equal Housing Opportunity | This is not a commitment to lend. *All loans are subject to credit approval. | mlsconsumeraccess.org/EntityDetails.aspx/COMPANY/181106